tax sheltered annuity vs 401k

An annuity is not tax-deductible. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity.

Financial Professionals Nexus Administrators

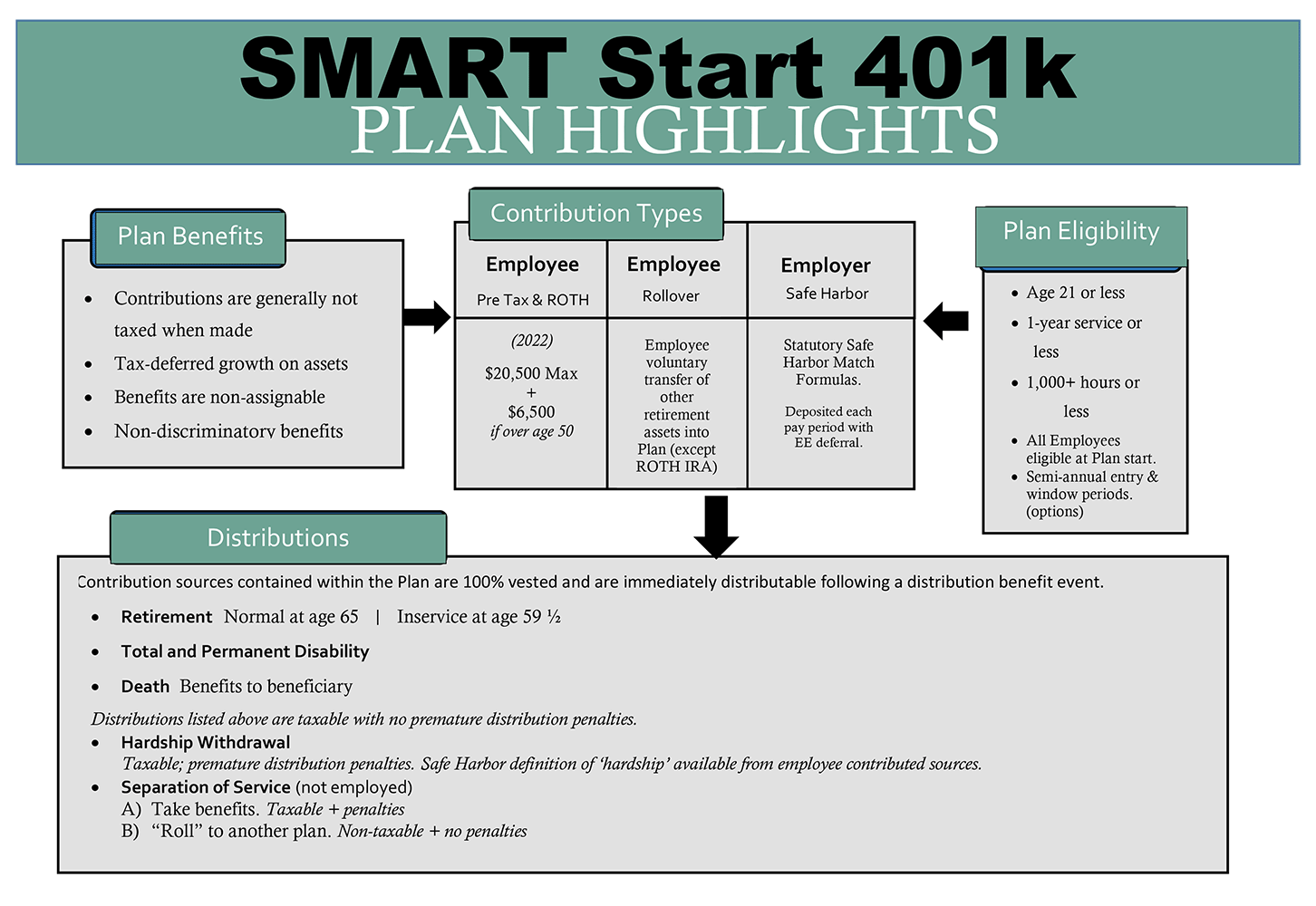

401k A 401k is a tax-deferred retirement account you can often get through your employer.

. Here is the complete annuity formula to understand the. As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403 b is a retirement plan offered by public. Both annuities and 401 ks provide a tax-sheltered way to save for retirement.

A tax-sheltered annuity TSA allows an employee to make contributions from his income into a retirement plan. A tax-sheltered annuity TSA is a retirement savings plan that allows employees to invest pre-tax dollars in an account to build retirement income. Ad True Investor Returns With No Risk.

A 403 b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Learn some startling facts.

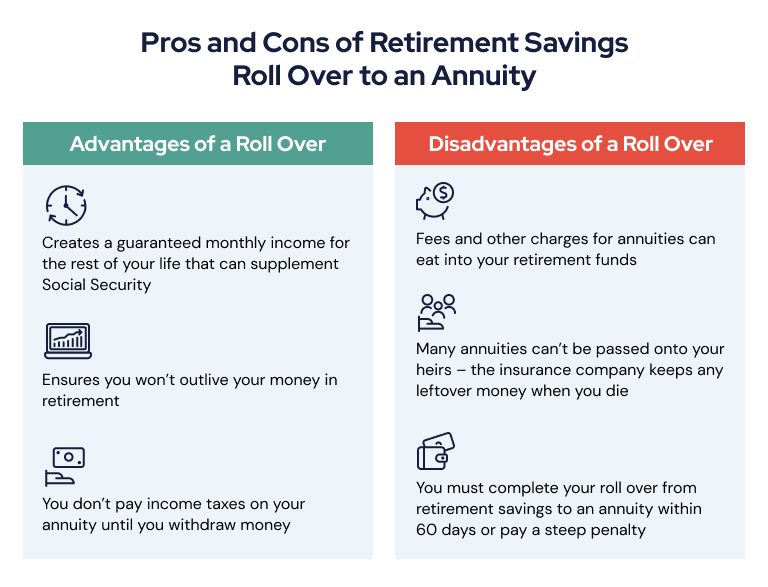

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Tax Sheltered Annuity Contributions. When its time to withdraw money in retirement you will pay taxes on your capital gains with annuities while paying taxes on the total distribution amount for 401 k accounts.

The contributions are deducted from the. Taxes need not be paid. This was despite annuity products remaining the most popular option among tax-sheltered annuity plan participants.

You contribute money to it customarily as a regular deduction from. As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403 b is a retirement plan offered by public schools and some nonprofit organizations with 501. A 403 b plan often referred to as a tax-sheltered annuity account TSA is a retirement plan offered exclusively by public schools and certain charities.

Annuities are often complex retirement investment products. It offers a double tax benefit. According to the IRS a 403b plan or tax-sheltered annuity TSA differs from a 401k in that it can only be offered by public schools and certain tax-exempt organizations.

An annuity is an Insurance Product. A 403 b plan is. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

401k is a retirement product or plan offered by the employer. A 403 b plan. Tax Sheltered Annuity Plans.

A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt. Learn More About American Funds Objective-Based Approach to Investing. If you have a qualified annuity contributions may be tax deductible up to a certain amount.

Learn More About American Funds Objective-Based Approach to Investing. However contributions are not tax deductible if you have a non-qualified annuity. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code.

A 403b plan is also another name for a tax-sheltered annuity plan and the features of a 403b plan are comparable to those found in a 401k plan. As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403 b is a retirement plan offered by public schools and some nonprofit organizations with 501. Ad Get The Most Income.

How Annuities Benefit A 401 k Annuities are flexible investment solutions that may help you achieve your long-term financial goals and provide a source of retirement income. Compare Live Annuity Rates From Over 25 Top Rated Companies. You will not owe income taxes on the investment returns of a 401 k or annuity until you.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. Find Out How With Our Free Report Get Facts. For 401k plans the total contribution limit including catch-up contributions is 64500 for 2021 and 67500 for 2022.

Understanding The Annual Reset Method The Annuity Expert

The Hierarchy Of Tax Preferenced Savings Vehicles

Withdrawing Money From An Annuity How To Avoid Penalties

Annuity Vs Mutual Funds Which Is Right For You 2022

Tax Sheltered Annuity Faqs Employee Benefits

How To Roll Your Ira Or 401 K Into An Annuity

Taxation Of Annuities Ameriprise Financial

Withdrawing Money From An Annuity How To Avoid Penalties

Annuity Taxation How Various Annuities Are Taxed

The Hierarchy Of Tax Preferenced Savings Vehicles

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

The Tax Sheltered Annuity Tsa 403 B Plan

The 401k Vs 403b Plan Find The Legal Difference Between Cc

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

:max_bytes(150000):strip_icc()/dotdash-comparing-iul-insurance-iras-and-401ks-Final-71f14693e37d4fb1b0736112179802b5.jpg)

Understanding Indexed Universal Life Insurance Vs Iras 401 K S

Annuity Vs 401 K What S The Difference Forbes Advisor

Massmutual What S In A Name A Retirement Plan Comparison

Qualified Vs Non Qualified Annuities Taxation And Distribution