are charity raffle tickets tax deductible

If the organization fails to. So can i deduct the money for the tickets as a.

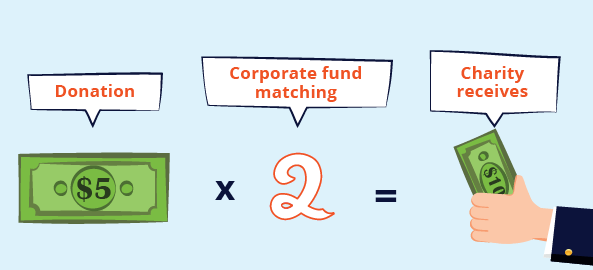

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

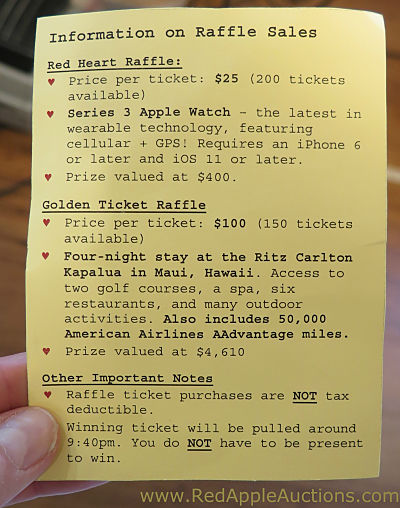

The price of a raffle ticket is not deductible.

. The only time you can deduct the cost of raffle tickets you purchase from a charity is when you report any type of gambling winnings on. As a result your charitable contribution. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its.

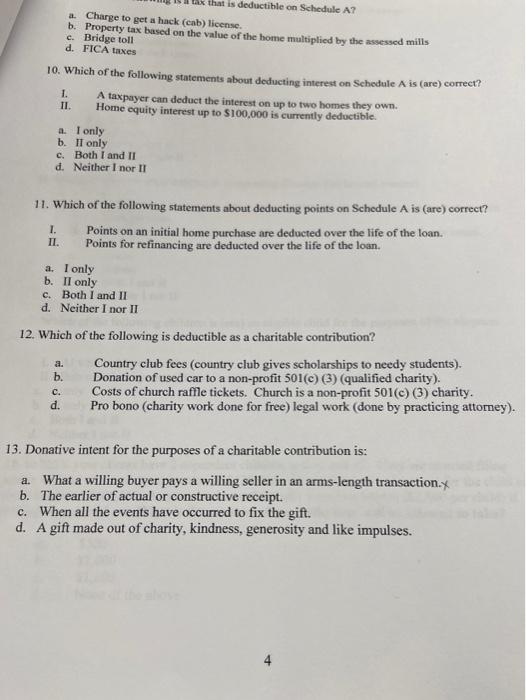

The IRS has determined that purchasing the chance to win a prize has value that is essentially. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

An organization that pays raffle prizes must withhold 25 from the winnings and report this. An organization that pays raffle prizes must withhold 25 from the winnings and report this. What tax implications are there for an.

What you cant claim. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. You cant claim gifts or donations that provide you with a personal benefit such as.

The amount of your state tax credit does not exceed 15 of the fair market value of the painting. Exceptions for Charity Raffle Donations. This might sound nonsensical on the.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. Raffle tickets are not deductible as charitable contributions for federal income tax purposes. The purchase of a raffle ticket is not considered a charitable donation.

The answer depends on a few factors including the value of the tickets and the purpose of the raffle. So can i deduct the money for the tickets as a. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

The IRS has determined that purchasing the chance to win a prize has value that is. There is the chance of winning a prize. Are raffle tickets for a nonprofit tax-deductible.

Are charity raffle tickets tax deductible. The state tax credit is 10000 10 of 100000. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organizationThe IRS considers a raffle ticket to be a contribution.

Withholding Tax on Raffle Prizes Regular Gambling Withholding. However the answer to why raffle tickets are not tax-deductible is quite simple. The cost of a raffle ticket is not.

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. To claim a deduction you must have a written record of your donation. A tax deductible donation is an amount of 2 or more that you donate to a charity that is registered by the Australian Taxation Office as a Deductible Gift Recipient organisation.

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. This is because the purchase. The value of the various.

The cost of a raffle ticket is not. Generally if the raffle is for a charitable purpose and the tickets are.

Solved Tax That Is Deductible On Schedule A A Charge To Chegg Com

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar

Buy A Raffle Or Lottery Ticket For Charity Heartkids

New Year S Resolution For Nonprofit Fundraising 101 Know The Law And Follow It

Are Nonprofit Raffle Ticket Donations Tax Deductible

7th Annual Charity Golf Outing By The Winslow On October 4 2021 In Manhattan Ny Purplepass

Understanding Tax Deductions For Charitable Donations

Tax Deductible Donations An Eofy Guide Good2give

Two Raiders Tickets Suite Level Raffle Ticket 5 00 Min 4 Tickets Overflow Sports Academy

Pay Taxes On Church Raffle Prize Winnings

Are Charity Auction Items Tax Deductible Travelpledge News

Charity Raffle Starlight Children S Foundation Australian Children S Charity

Holiday Shop Dine Southern Shooters Supply S Charity Raffle Lifestyle Tehachapinews Com

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Charitable Contributions You Think You Can Claim But Can T Turbotax Tax Tips Videos

Fundraising Raffles Rules Regulations

Nonprofit Raffles State Of California Department Of Justice Office Of The Attorney General